The Daily Market Forecast... do nothing.

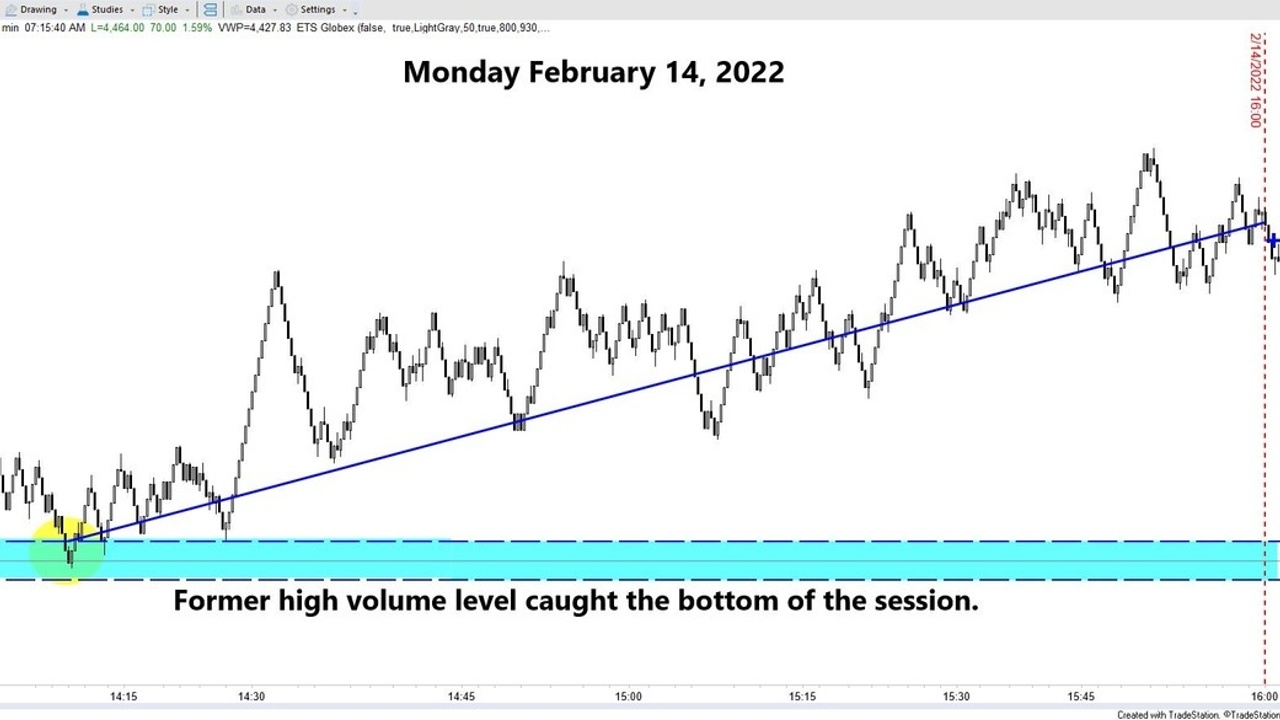

Monday’s Blog Results: Neither suggested volume level triggered. Team members saw price reverse on a former high-volume level running for 37.25 points.

Quick Tip: Do nothing.

Successful trading skills are very different than how we’ve been conditioned to behave.

Here’s an example via some advice from arguably one of the best traders in history, Jim Rogers.

“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime."

Who was taught this concept growing up? Did Dad ever say, “Do nothing?” Mom? Your boss?

OK… I’m taking literary license here because we all know Jim didn’t vegetate between trades. But what IS important is he didn’t trade. Research? Sure. Study? Yup. Plenty of productive tasks we can do while waiting for the “money lying in the corner.”

Get comfortable with the idea of being a trader who can “not trade.”

Today’s Best S&P Futures Turning Points:

Short Level: Sell 4497.50 stop 4503.25 (sam...

The Daily Market Forecast... F.E.A.R.

Friday’s Blog Results: The suggested short caught the top of the day session and ran for 41.75 points to the next volume level. Team members knew about the 4174 level and saw that bounce 15.75 points.

Today’s Lesson: F.E.A.R.

Trading breeds emotions. It’s all about the money and most of us have emotional reactions to money. While greed is a killer, fear of loss is also serious problem for unskilled traders.

There is an acronym for “fear” that is important here. F.E.A.R. stands for False Evidence Appearing Real.

The chart above shows a good example of this. Looking at price soaring straight up you might be fearful of taking the suggested short at 4515.75. Your fear would have kept you out of a 41.75-point runner. Not good.

You might be thinking “What’s so false about this rally? It looks very real!”

The fact is strong moves in one direction will usually correct in the opposite direction rather violently. Scan hundreds of charts and see for yourself. The reality behind this phenome...

The Daily Market Forecast... anticipation

Thursday’s Blog Results: The CPI report crashed the market and the open was well below the suggested buy level. After all, you get this blog around 8AM ET and lots can happen in the meantime. One of the entry rules we follow is taking breakouts if reversals fail. The chart above shows the result.

Today’s Lesson: Anticipate.

So much of your time is spent waiting for a setup. Be productive and plan your next or other trades. Anticipate.

Looking at the chart above you’ll see the failed short entry. Price moved fast through the volume level and gave you no chance to consider the long breakout in real time. That decision needed to be made in advance.

Another good reason to anticipate is psychological. The short entry failed instantly and that means you lost the maximum you allocated for the trade. Experienced traders are accustomed to losing so there is rarely an emotional reaction. Newer traders will experience angst over the loss and that could affect your decision to keep trading and...

The Daily Market Forecast... abundance

Wednesday’s Blog Results: The suggested short level @ 4575.00 ran for 16.75 points with only 1 tick of adverse move. Don’t you feel more confident when you’re on a winning streak? (Careful…)

Today’s Lesson: Abundance.

Success starts with your orientation toward life. In Larry Wilson’s book, Play to Win: Choosing Growth Over Fear in Work and Life, he reveals the two orientations that you must choose between.

- Play to win.

- Playing not to lose.

What’s the difference?

People who have a positive attitude packed with a view of abundant opportunities willing to overcome challenges, grow and risk for gain are “Playing to Win.”

Conversely, people who need to remain in their comfort zone, looking for the “easy way,” have a skeptical, negative attitude and don’t see opportunities clearly are “Playing Not to Lose.”

Successful traders Play to Win. One key component of their formula is the mindset of abundance. If you don’t believe great trades are coming your way all the time then you’ll...

The Daily Market Forecast... exit here.

Tuesday’s Blog Results: Another runner yesterday… 17 points. But this one was different. Here’s how the buy level was suggested:

“Long Level: Buy 4371.00 stop 4367.25 which would require a ton of patience. Consider buying 4500.25 stop 4494.50 IF price trades above and retraces back.

Nice bonus idea, eh? Join our team and get these every day.

Today’s Lesson: Exit here.

Every trade you exit only has two outcomes once you’re filled.

- You left money on the table.

- You got out just in time.

Those two outcomes are packed with emotional response. “Damn… I got out too soon” (anger). “Holy smoke am I on fire today” (elation).

Do you think your emotional reaction might influence your next trade?

Curtis Faith, one of the original Turtle Traders and author of Way of the Turtle, summed it up succinctly: “Winning traders think in the present time and avoid thinking too much about the future. Being right (winning) and being wrong (losing) is not the approach to use. Ignore outcome bias...

The Daily Market Forecast... "real" courage

Monday’s Blog Results: The suggested buy level @ 4476.50 delivered a 38-point runup. How much did you keep?

Today’s Lesson: How to get “real” courage.

Hopefully you’re following a rule-based trade plan (if not, get one or stop trading). If so, you’ve probably experienced that trade setup that just didn’t look or feel right. The rules say “BUY” and price is plunging fast. All you can think about is that stop getting filled instantly and you’re underwater again.

On the chart above, notice the price action just before the level was touched. Just before entry. The steep and fast move down. And you’re supposed to buy at this number that some guy (me) told you was a good turning point.

Would it take “courage” to enter that trade? Being courageous sounds too risky to me. I get mental images of danger ahead and I’m supposed to plow right through and prevail… without pain?

Confidence is the “real” courage in trading. It’s knowing from years of study, practice, documentation, review, and re...

The Daily Market Forecast... near wins.

Friday’s Blog Results: The suggested buy level @ 4454.25 offered 8.50 points before reversing. The suggested short level failed by only 5 ticks and then plunged 32.25 points to the close.

Today’s Lesson: Near wins.

As you review the trades from Friday you’ll likely pause on the short entry, which failed by only 5 ticks before offered a sizable winner.

Was the stop too tight? Was the entry too soon? You’re thinking about how you could have gotten into the trade.

Now if you’re a discretionary trader with no evidence of edge, just intuition and experience, that may be the correct review process.

Our team is rule-based. We work with statistically relevant evidence to make trading decisions. Pondering the reasons how we could have “made” it a winner is a waste of time. Specifically, we know that our entry and stop were correct probability-wise.

The review process then becomes “reframing.” Taking a negative and making it positive. Ask yourself, “More or less, did that volume level work...

The Daily Market Forecast... Swiss army knife?

Thursday’s Blog Results: The suggested buy level ran for 24.25 points. Which stop did you choose? The tighter stop lost. The looser stop enjoyed the 24.25-point run. How did you decide which to take? (Re-read yesterday’s blog about market conditions and exit rules.)

Today’s Lesson: Swiss army knife?

Technical indicators are helpful. Yes, most are lagging and we’re always looking for leading information but used skillfully indicators can help build your case for taking a trade or not.

Think about trend. If you’re concerned about trading with the trend then you need a definition of what that looks like and now you’re using historical information.

Where you can run into trouble is combining indicators that are directly related to each other. A moving average and a chart trendline for example. No need for both. Pick one.

You can benefit by combining different types of indicators. Trend, volatility, momentum, volume, sentiment, open interest, and intermarket data are indicators you can...

The Daily Market Forecast... exits

Wednesday’s Blog Results: The suggested buy level ran for 22.75 points. How much did you keep?

Today’s Lesson: Exit alternatives.

The money is made in the exit, not the entry. That’s not to say you can randomly enter a market (although Market Wizard trader Linda Raschke was quoted as saying you could give her any entry and she’d optimize the result).

The long trade yesterday did have a “near perfect” entry. Buying at 4540 and seeing only 1 point of adverse move (all orders there were filled). It ran for 22.75 points before returning to the level and eventually hitting the stop. Depending on your exit rules this great entry could have been a small winner, solid winner, breakeven, or a loss.

Market conditions are important to guide you to your exit rules. Is price moving fast or slow? Is the expected range for the day wide or narrow? Is there a catalyst on the horizon that could impact price direction? Lots to consider.

Here’s some popular exit rules to consider after you’ve analy...

The Daily Market Forecast... wrong > right

Monday’s Blog Results: The suggested short @ 4443.00 stopped out for a 4.50-point loss. Team members saw the breakout setup that ran for 56.25 points.

Today’s Lesson: Wrong > right.

Curious how I’m going to dance out of that statement?

If you’re always “right” then you’ll never be open minded enough to change for the better. Being flexible and open-minded to new ideas is a huge advantage in trading.

I’m not saying you simply agree with every new idea you hear. I’m saying that when you’re presented with an intriguing idea (setup, rule, etc.) you owe it to yourself to investigate the value of it. And if you find improvement, then admit you were wrong and change.

I was told the great investor George Soros wrote in his book about a trade he took in the Japanese Yen. It ended up a monster winner. His first entry was short based on his analysis. It failed quickly so he doubled his size and went long. Just like that.

We are all going to be wrong or mistaken at times. The key to success...