The Daily Market Forecast... open mind

Tuesday’s Blog Results: Neither suggested level triggered during the day session.

Today’s Trading Tip: Have an open mind.

You have a rule-based plan with edge. If not, get one or quit trading. Rules in this case are meant to be followed. You want to be as machine-like as possible. Not easy for many of us, but that’s the goal.

Imagine that your plan is working fine. Your discipline following it is very good. Then you meet a trader who tells you there is a better way. Not a huge change to your plan, just a “tweak.”

What’s your reaction?

- Nod politely, congratulate her on finding that “gem” and carry on doing what you’ve always done.

OR…

- Get excited, immediately re-write your rules, and expect a big improvement.

You’ve probably met both types of traders. Fixed, disciplined, rarely willing to change and excitable, glib, and always changing.

Consider a middle ground. When you hear of a “better way” don’t simply dismiss it because it’s not “what you do.” Don’t just glibly cha...

The Daily Market Forecast... what's your style?

Friday’s Blog Results: Neither suggested level triggered.

Today’s Trading Tip: What’s your style?

With all the online trading education available now; blogs, podcasts, books, newsletters, video courses, tip sheets, live rooms, daily, weekly, monthly… you are SO LUCKY! Excess supply + limited demand = great value, they’re all a great BUY.

Except you’re not vetting them properly. You see, in trading there are TOO many ways to beat the market. Yup. You should know this because if everyone did the same thing no one would be on the other side of your trade! I would guess that most of these offers work just fine! But the abundance of strategies, indicators, and mentors can be more confusing than helpful.

Why? Because if you choose the wrong market, style, or strategy… the one that doesn’t resonate with your personality, it doesn’t matter how successful anyone else is trading it. You’ll fail. No need to start this way.

After 14 years of helping over 4000 would-be traders find their “dres...

The Daily Market Forecast

Thursday’s Blog Results: The suggested buy level only ran for 8.25 points. How much did you get?

Today’s Trading Tip: On Vacation…back on Monday

Today’s Best S&P Futures Turning Points:

Short Level: Sell 4685.50 stop 4690.75.

Long Level: Buy 4552.25 stop 4546.50.

Trade well,

Mike Siewruk

P.S. Tired of trading alone? Need more quality setups? Learn how our team-based approach can accelerate your trading performance. Click here for FREE video training.

The Daily Market Forecast

Wednesday’s Blog Results: Neither suggested level triggered. The Team saw a secondary level fill (and become the low of the day) running for 24.75 points.

Today’s Trading Tip: On Vacation…

Today’s Best S&P Futures Turning Points.

Short Level: Sell 4777.00 stop 4781.75. (Same as yesterday).

Long Level: Buy 4684.75 stop 4679.00.

Trade well,

Mike Siewruk

P.S. Tired of trading alone? Need more quality setups? Learn how our team-based approach can accelerate your trading performance. Click here for FREE video training.

The Daily Market Forecast

Tuesday’s Blog Results: The suggested long level stopped out fast. The short level was never touched.

Today’s Trading Tip: On Vacation…

Today’s Best S&P Futures Turning Points.

Short Level: Sell 4777.00 stop 4781.75. (Same as yesterday).

Long Level: Buy 4652.00 stop 4645.25.

Trade well,

Mike Siewruk

P.S. Tired of trading alone? Need more quality setups? Learn how our team-based approach can accelerate your trading performance. Click here for FREE video training.

The Daily Market Forecast

Monday’s Blog Results: The suggested short worked for 32 points in the Globex session but didn’t re-trigger (valid) in the day session. Price collapsed and opened below the suggested long level.

Today’s Trading Tip: On Vacation…

Today’s Best S&P Futures Turning Points.

Short Level: Sell 4777.00 stop 4781.75.

Long Level: Buy 4639.75 stop 4634.00

Trade well,

Mike Siewruk

P.S. Tired of trading alone? Need more quality setups? Learn how our team-based approach can accelerate your trading performance. Click here for FREE video training.

The Daily Market Forecast... what you forgot

Friday’s Blog Results: Your suggested entries didn’t trigger.

Today’s Trading Tip: What you forgot.

Have you ever done something stupid and realized you knew that was the wrong thing to do (or say)? You knew it all along and for some reason you lapsed and momentarily forgot.

You might have experienced this feeling while learning. The coach says “this way is the best” and you think “I used to do that! Why did I stop!” Human nature.

There was a beautiful 8:1 setup in our trading room on Friday (see chart above). This was a reversal entry and could have been set/forgot way before price ever came near the level.

This is something I repeatedly say during our live sessions. “Decide now and set your trades.” With futures orders being time-stamped at the exchange you’ll get more fills this way.

Did I set the trade? Nope. I saw price soaring up and tried to enter but it moved too quickly and I didn’t fill. What the heck was I thinking? I preach this simple habit of choosing the tr...

The Daily Market Forecast... volume redefined

Thursday’s Blog Results: Your suggested entries didn’t trigger. The profile was wide open due to the rapid drop after the FOMC announcement.

Today’s Trading Tip: Volume redefined.

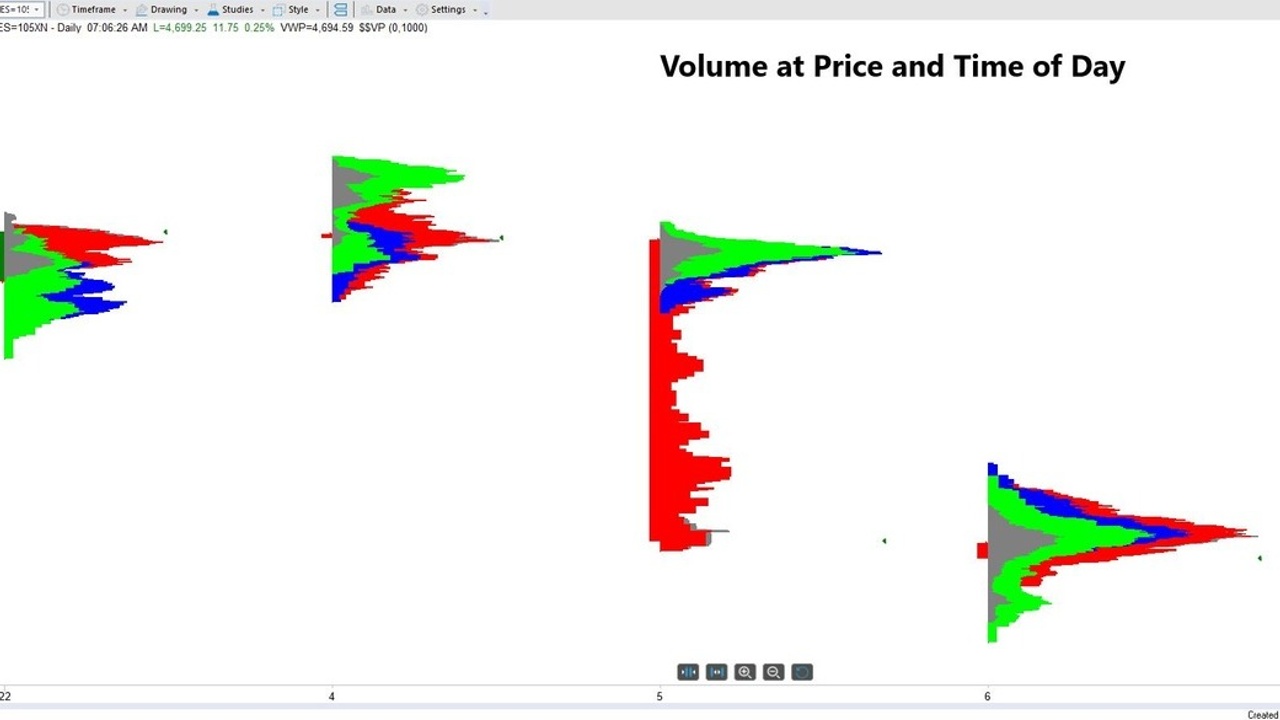

In technical trading there are only a few variables to consider: price, volume, and time. Every technical indicator or method is derived from variations of these variables.

Most traders look at volume within a time interval. They see volume in a histogram at the bottom of the chart. Good to know.

The chart above flips the volume from the time axis to the price axis. Now you see the volume at specific prices. Much better to know.

Why? Large traders (institutions) approach buying and selling different than you and I. When we want to buy or sell we click a mouse and it’s done. Our position size is small.

Large traders can’t do that. They need to accumulate and distribute their positions in their chosen price ranges.

Let’s say you consume 8 bottles of mineral water a day. The local grocer puts your b...

The Daily Market Forecast... puzzle solved

Tuesday’s Blog Results: No free trades triggered. Team members saw another great Globex session with a breakout to all-time-highs running for 15.50 points.

Today’s Trading Tip: Puzzle solved.

Being curious and constantly learning is critically important to your trading… and your longevity! Resolve to get in this habit:

- Choose a trading topic you know little about.

- Research it thoroughly using the Pomodoro Method.

- Act (trade) on your new-found knowledge

- Journal every trade.

- Review and improve your skill.

- Start the process over again with a new topic.

Too busy to get started right now? I’ll do it for you. Email me the topic you’re curious or confused about and I’ll share the results in a future blog post.

Today’s Best S&P Futures Turning Points:

Short Level: Sell 4800.50 stop 4805.50.

Long Level: Buy 4742.00 stop 4739.00. Same as yesterday.

Happy New Year!

Mike Siewruk

P.S. Tired of trading alone? Need more quality setups? Learn how our team-based approach can accel...

The Daily Market Forecast... how orders fill.

Thursday’s Blog Results: Your suggested buy level at 4786.25 ran for 13.50 points.

Today’s Trading Tip: How fills work.

Trading futures contracts on the Globex exchange (cmegroup.com) might be the fairest market in the world. Why? Because the orders are time-stamped upon arrival and filled on the first-in first-filled basis. No one gets preference. You’re in a line and it doesn’t matter if you’re a small retail trader or an institution.

Real-world example: Looking at the winning trade from yesterday (see chart above) you’ll notice that price turned right on the suggested buy level. Not even one tick penetration. This does NOT mean you got filled. Some contracts were filled there but maybe not yours. Maybe you were too far back “in the line” and price bid higher before you filled.

One of the many benefits of this strategy is that you can place these orders when you receive this email. It was sent at 7:14 AM ET and the trade was activated at 9:31 AM ET. Entering the order a couple ...