The Daily Market Forecast... expect slippage

Friday’s Blog Results: The suggested short at 4380.50 ran for 15.75 points.

Today’s Lesson: Expect some slippage.

One aspect of trading many people don’t consider is order execution. At first glance you may think “How hard could buying and selling be? Click a mouse!” Getting a precise price is not always possible, though.

For example, the other day I was live testing a new process whereby the entries and exits were set at different prices and quantities. Scale-in, scale-out. There were significant advantages… less risk, potentially greater reward.

My platform allows for most of the orders to be automated, but not all. This meant I needed to pay attention in real time to ensure all the rules were met. OK, can do. Unfortunately, price moved extremely fast with volatile swings making it impossible to duplicate all the benefits of the rule set. It was better, and in calmer markets likely more so.

The takeaway here is that you need to start with a strategy that has significant edge. ...

The Daily Market Forecast... "Take 'em all."

Thursday’s Blog Results: The suggested short at 4411.00 stopped out by 3 points. No long triggered.

Today’s Lesson: “Take ‘em all.”

Found this quote the other day reading one of my favorite trader/educators, Larry Williams (https://www.ireallytrade.com). He was talking about the trap we all fall into of picking and choosing our trades as opposed to taking every signal (filters are still honored).

“If you pick and choose, you will invariably pick the losers and walk away from the winners. It is nothing personal, we all do, and the way to beat this devil is to take ‘em all.”

This is not news to me but being the imperfect human that I am, I fell into this trap the other day. Reading this shortly afterward was coincidental but great timing for me!

If you’ve ever struggled with the feeling that you pick the losers and miss the winners, try lowering your risk (or size) and “take ‘em all.” Larry Williams has been beating the market for decades and worth listening to.

Today’s Best S&P Fu...

The Daily Market Forecast... expectations

Wednesday’s Blog Results: FOMC day paid out HUGE. Your suggested short @ 4443.00 caught the top of the session and ran for 98 points to the suggested buy at 4345.00 (which did see a 7-point bounce before stopping out). How much did you get?

Today’s Lesson: Expectations and reality.

People are impressionable. Sometimes that can be a problem. We can have great expectations that won’t match up with reality. A “good result” can look like a failure after a big win.

Here’s an example. Let’s say yesterday was the first time you traded the levels I share in this blog. Your first trade was a 98-point runner. Clearly you’d be ecstatic. What would your expectations be for future trade suggestions? If all you saw were 5 and 10-point winning trades for weeks on end you might be a bit disappointed. But those are more the reality.

This happened to me years ago when I started trading in the late 90’s. The strategy I found worked so well during the dot-com bubble that when volatility vanished it tu...

The Daily Market Forecast... reframing

Tuesday’s Blog Results: Heartbreaker! The suggested long @ 4293 found the bottom of the session and ran for 102.50 points to the suggested short @ 4395.50 which was the top of the session and ran for 44 points to the close! Unfortunately, the buy only ran 11.25 points before stopping out and the short stopped out before running.

Today’s Lesson: Reframing.

You had the “top” and “bottom” levels of the market in your hands before the open. The day had a range of 126.25 points. How could you NOT make a killing? Stop placement was the cause yesterday.

How you react to this result, a modest winning day when you could have crushed it, is critical. Getting emotional and changing your rules to fit one event is not OK.

Instead, you should practice “reframing.” This is a simple technique whereby you change the event from negative to positive.

True that you didn’t get the big winning day, but the volume levels WORKED like a charm. This should be a confidence builder. Feel good about your stra...

The Daily Market Forecast... confidence

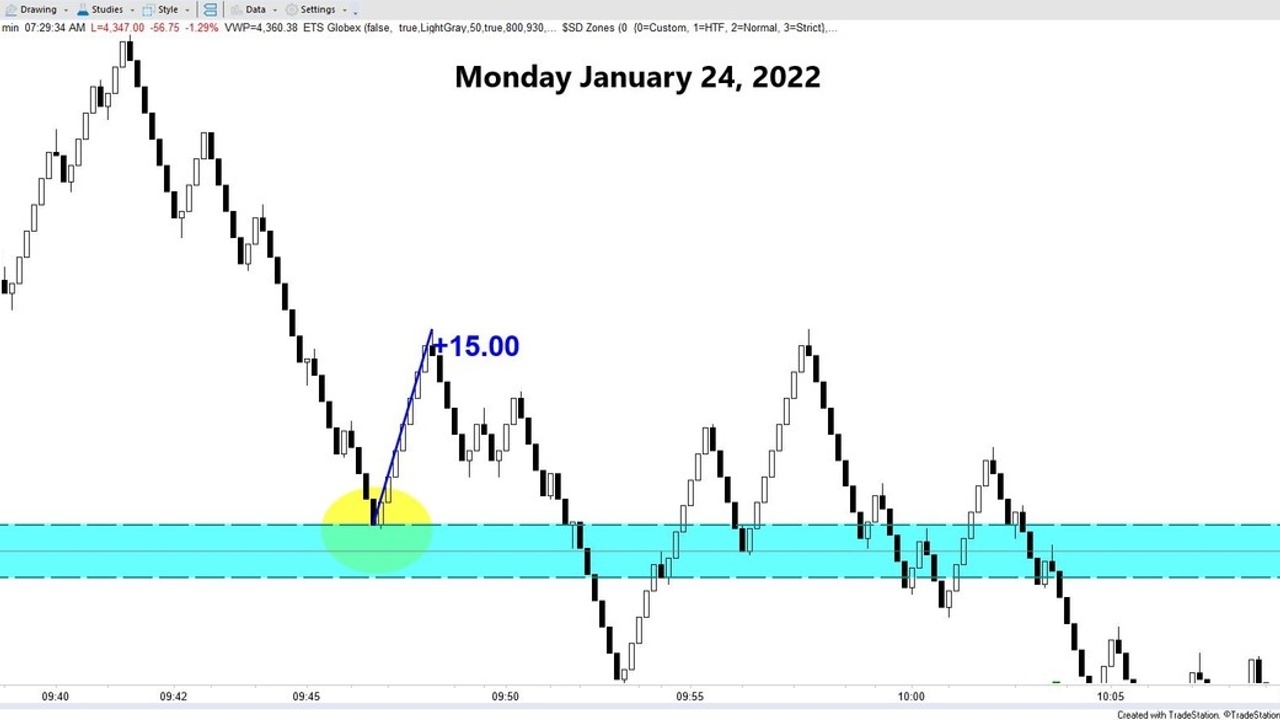

Monday’s Blog Results: What a day! The suggested buy level at 4303.00 was good for a 15-point bounce. Not much on a 198-point range day, but that was only one of 28 setups the Team here saw get filled.

Today’s Lesson: Have confidence.

Before you can have confidence as a trader you need to be confident in your rules. There is a difference.

The way you get confidence in your rules is to perform deep research in all market conditions. Document thousands of trade setups. Look for edge based on probabilities.

The way you get confidence in your trading is to stop thinking you can “beat” the probabilities and just follow the rules like a machine.

Yesterday is a great example. The S&P sold off hard dropping almost 5% (from high to low). It gained all that back to close higher. During the plunge you might have been thinking “There is no way I’m taking a buy signal and trying to catch this falling knife.” Big miss with that thought, huh? Volume levels yesterday performed better on the long ...

The Daily Market Forecast... risk number

Friday’s Blog Results: The suggested short @ 4469.50 was a beautiful 39.75-point runner to the next level. How much did you get?

Today’s Lesson: How to find your “risk number.”

There is a popular risk management tool that uses a fixed percentage of your account size to determine per-trade risk (and ultimately position size). It’s simple to use and highly effective. Here’s how it works:

Account size: $10,000

Fixed Percentage: 2% (your choice up to 2%, higher is rarely suggested).

Per Trade Risk: $200

Stop Loss: $100

Position Size (contracts): 2

So why is this formula so effective? Because as your account grows the Per Trade Risk grows allowing you to trade larger size. Conversely, if you’re in a drawdown the Per Trade Risk will be less limiting your position size.

In fact, just to put it in perspective for you, using the numbers above you would have to endure 35 losing trades IN A ROW to hit your “no-trade limit” (less than $100 risk). Based on the Theory of Runs, assuming a sa...

The Daily Market Forecast...you don't know

Thursday’s Blog Results: Plenty of range yesterday! The suggested short @ 4565.25 stopped out. The suggested long @ 4494.75 bounced for 10.75 points BUT fill was an issue… the MES contracts touched the level, the ES did not. If you missed it, which was likely, reframe your thinking: Volume Levels work fine, we can’t always get filled.

No problem with fill last night in the Globex session. Team members had the above chart planned ahead and received by 5:15 PM ET. Both trades were ideal set/forget entries making for a VERY pleasant morning today!

Today’s Trading Tip: You don’t know.

We love to know. It’s natural to want to know “why,” “when,” and “where.” One problematic personality type I’ve met over years in trading education is the person who NEEDS to know with certainty. Trading is a game of probabilities, not certainties. Check yourself when you start getting anxious about not “knowing” the future.

Take yesterday’s profile for example. When the short failed in the morning and ...

The Daily Market Forecast... weather report

Wednesday’s Blog Results: The “alternative” long entry worked like a charm for a quick 14.75-point run. How much did you bank?

Today’s Trading Tip: The weather report.

Years ago, the weather report was a big joke. Especially in Michigan where I grew up. Rarely did the forecast hold. Today, the technology exists to accurately forecast the weather. You wouldn’t think of washing your car today until you checked for foul weather. You wouldn’t blindly carry your umbrella every day either.

Forecasting the market has come a long way, too. It’s not nearly as good as the weather report but it can be helpful. The forecasting tools you can use for the market give you edge in probabilities. Not certainties. But that’s OK. Wouldn’t you rather have some probabilities guiding your trading than going in blind?

Our trading team follows a detailed forecast for both the day and Globex sessions. They are different so the extra work is necessary to maintain edge.

Here’s a great example of how probab...

The Daily Market Forecast... open mind

Tuesday’s Blog Results: Neither suggested level triggered during the day session.

Today’s Trading Tip: Have an open mind.

You have a rule-based plan with edge. If not, get one or quit trading. Rules in this case are meant to be followed. You want to be as machine-like as possible. Not easy for many of us, but that’s the goal.

Imagine that your plan is working fine. Your discipline following it is very good. Then you meet a trader who tells you there is a better way. Not a huge change to your plan, just a “tweak.”

What’s your reaction?

- Nod politely, congratulate her on finding that “gem” and carry on doing what you’ve always done.

OR…

- Get excited, immediately re-write your rules, and expect a big improvement.

You’ve probably met both types of traders. Fixed, disciplined, rarely willing to change and excitable, glib, and always changing.

Consider a middle ground. When you hear of a “better way” don’t simply dismiss it because it’s not “what you do.” Don’t just glibly cha...

The Daily Market Forecast... what's your style?

Friday’s Blog Results: Neither suggested level triggered.

Today’s Trading Tip: What’s your style?

With all the online trading education available now; blogs, podcasts, books, newsletters, video courses, tip sheets, live rooms, daily, weekly, monthly… you are SO LUCKY! Excess supply + limited demand = great value, they’re all a great BUY.

Except you’re not vetting them properly. You see, in trading there are TOO many ways to beat the market. Yup. You should know this because if everyone did the same thing no one would be on the other side of your trade! I would guess that most of these offers work just fine! But the abundance of strategies, indicators, and mentors can be more confusing than helpful.

Why? Because if you choose the wrong market, style, or strategy… the one that doesn’t resonate with your personality, it doesn’t matter how successful anyone else is trading it. You’ll fail. No need to start this way.

After 14 years of helping over 4000 would-be traders find their “dres...