The Daily Market Forecast... Abundance

Friday’s Results: Neither suggested trade triggered in a range-bound day.

Quick Tip: Abundance

The more trade setups you have available the choosier you can be in taking trades. Abundance is good. The opposite is true. Too few setups can find you taking trades that are not ideal.

Given that markets are changing character from trend to range and volatile to quiet, the ideal solution for abundance is to have multiple strategies that are tuned for those varying conditions.

In yesterdays’ Optimizing Multi-Strat Trading mini class we showed how to gain this edge. Watch the recording here (time sensitive discount offers expiring at midnight tonight!).

Today’s Best S&P Turning Points (in fast moving markets consider a wider stop and less size):

Sell 3943.00 stop 3947.25 (same as Friday).

Buy 3834.50 stop 3829.75 (same as Friday).

Trade Fearlessly,

Mike Siewruk

The Daily Market Forecast... trend or reversal?

Thursday’s Results: The short @ 3900.75 stopped out. The breakout long was only good for 8 points.

Quick Tip: Trend or Reversal?

You might be thinking that trading the trend sounds safer than picking a turning point. Many strategies focus on trading in the direction of a larger time frame trend. This makes sense and it works.

But it’s not necessarily “safer.” Your initial priority is making sure your trade plan rule set has “edge,” meaning over time it’s profitable. After you have that the idea of “safe” becomes irrelevant. Just trade the strategy that appeals to you psychologically.

Here’s an even better idea: Learn both trend and reversal trading then use the correct strategy for the current market condition. Sounds simple but just like trading in general, not necessarily easy. Given enough research and statistical evidence, you can get an edge with your strategy choice decision.

We’ll be covering this concept in our new FREE mini class “Optimizing Multi-Strat Trading” on S...

The Daily Market Forecast... Volume Bars

Friday’s Results: Friday’s Results: Neither trade suggestion triggered.

Quick Tip: Volume/Share Bars

Trading can be simplified to the analysis of 3 variables: price, time, and volume. Using time-based charts is most common and important. In them you can see wide and narrow range bars/candles giving you evidence of where big moves started and slowed or stopped. Good to know.

Another view that offers some “hidden” information is the Volume or Share bar. These are time independent. They paint a new bar after “X” number of shares/contracts have traded. If you’re trading an active futures contract like the S&P (or a stock like AAPL) you can have your share bars set to 10,000 (or more) to instantly “see” what volume filled in a move by simply counting the bars. That can be accomplished by adding a volume indicator to the chart, but with the share bars you’ll see the trend differently on the chart. For trend traders this is a big benefit. Try it.

Learn more about multi-strategy trading...

The Daily Market Forecast... Decide / Correct

Thursday’s Results: The short @ 3817.75 caught the high of the session and ran for 51 points (if you used the wider stop suggestion).

Quick Tip: Decide / Correct

Predictions, forecasts, and feelings. Helpful or not? You could argue that the only thing that matters is what price action is suggesting in present time. Fair argument.

But are you prepared for what price action is suggesting? Are you using the correct strategy for the current market conditions? Will today be a trending or range-bound day? It’s helpful to consider this before you get started. If the market changes character then you can change your outlook. It’s good for your confidence to have an outlook from the start.

I read a quote the other day that pertains. Nina DiSesa, named by Fortune magazine as one of the 50 most powerful women in American business (in 2000) said “You can always correct a poor decision, but if you do nothing, you can never get the time back.”

Get in the habit of making decisions and correc...

The Daily Market Forecast... Pay Yourself

Wednesday’s Results: Neither trade suggestion triggered in a relatively narrow-range spiky day.

Quick Tip: Pay Yourself

If you’re like many retail traders you are focused on growing your trading account so you can increase your risk and ultimately your expected reward. Taking a “paycheck” from your trading account seems like taking a step backward.

The trading account is intangible. The figures on the statement don’t mean the same to you as a tangible reward. Psychologically, you NEED to be rewarded for a job well done. Make those wins REAL.

Here’s a simple trick for getting paid, growing your account, and improving your trading skills simultaneously:

1. Determine your payday (weekly, bi-weekly, monthly).

2. Log your trading account balance at the start.

3. On payday calculate your gain/loss in the account.

4. Pay yourself a pre-determined percentage of the gain. Take nothing if you lost.

If you’re more interested in growing the account make the percentage small, maybe...

The Daily Market Forecast... Artful Exit

Tuesday’s Results: The buy @ 3891.50 stopped out instantly.

Quick Tip: Artful Exit

Entries for directional trades are easy. You expect price to rise or fall and you have supporting evidence where the entry should be. Not a whole lot to think about.

Exits are another story. While a good entry is important, you make or lose all the money when you exit. If you monitor your open trades you’ll see the open profit or loss moving up and down. Watching money come and go can be an emotional experience, especially for the newer trader. Not good.

You need rules in your trade plan for exits. But rather than have one static rule set you should have multiple exit strategies to use in different market conditions. Once you enter, the market characteristics may change, and your original exit idea is less effective.

Here’s one alternative to consider. If you’re trading multiple strategies (tuned to different market conditions) you will frequently see an entry signal on one strategy and an exit...

The Daily Market Forecast... Visualization

Friday’s Results: The suggested buy @ 3675.50 ran for 36.25 points.

Quick Tip: Visualization

In sports psychology one highly successful technique is positive visualization. In essence, the athlete will vividly imagine and visualize in the mind’s eye the result of what they are about to do.

Golf is an easy example for clarification. Top golfers, coached by sports psychologists are taught an interesting visualization technique. Famous golf coach and psychology professor Dr. Richard Coop instructs this way:

- Before you take your shot, visualize exactly what it will look like, including minute details like how far it will roll after landing. Jack Nicklaus claimed it changed his game.

- HOWEVER, if you address the shot with even a hint of a negative attitude (indecision, concern, lack of focus, etc.) step back and reframe your mind until you are visualizing the perfect shot.

How does this apply to trading? While traders are not in control of the physical outcome like athletes, they a...

The Daily Market Forecast... Epictetus

Wednesday’s Results: The suggested buy level at 3648.75 stopped out for a 3.50-point loss (per contract).

Quick Tip: Epictetus

Not being knowledgeable in Greek philosophy I had no idea who Epictetus was. But a famous quote of his is applicable to trading so I’m sharing:

“Men are disturbed, not by the things that happen, but by their opinion of the things that happen.”

What’s your opinion about losing?

Losing is a fact of life. Reacting to it with destructive opinions (beliefs) won’t help. Look at each loser carefully. You either followed the rules precisely or you didn’t. Journal all the trades with the reason why you didn’t. Scan this journal in your morning routine now and then to refresh your memory on what not to do.

Today’s Best S&P Turning Points:

Sell 3755.50 stop 3761.25 (in a fast-moving market consider a stop at 3763.75 and size down).

Buy 3675.50 stop 3679.75.

Trade Fearlessly,

Mike Siewruk

P.S. Did you know there are MANY techniques and formulas you can use to ...

The Daily Market Forecast... Simple Not Easy

Wednesday’s Results: Trading was suspended for FOMC volatility.

Quick Tip: Simple Not Easy

You’ve probably heard the phrase “trading is simple, it’s just not easy.” Indeed, trade plans can be simple to execute but because of our thoughts, emotions, and behaviors we make it hard to follow thus missing the result we want.

Let’s say your “simple” trade rules were based on 1) Determine the big picture trend, 2) Sell rallies in a downtrend on a shorter time interval, 3) Buy dips in an uptrend on a shorter time interval. This is not only simple, but it makes sense. Price moves in waves of impulses and corrections within a trend.

The stock market is in a big picture downtrend. You should have sold yesterday’s rally on the FOMC news. Had you done that you’d be looking at a huge winner as the market is opening down today around 2%! If you didn’t follow your rules, if you didn’t make it “easy,” it was because of your thoughts and emotions.

Dr. Woody Johnson dives deep into this formula in...

The Daily Market Forecast... Sweet Dreams

Monday’s Results: The buy at 3779.50 stopped out for a 4.25-point loss (per contract).

Quick Tip: Sweet Dreams

The futures market opens at 6:00 PM ET. It’s called the Globex session and it is easier money than the day session. Why? The participants are different. Day session volume brings out all the large lot and algo traders and that creates a noisy effect on price action.

If you’re thinking “I don’t have the time to analyze the market and KNOW where to place those Globex trades” then you’re in luck. We provide our members a complete trading plan for the Globex session every market day around 5:15 PM ET, that’s 45 minutes before the open.

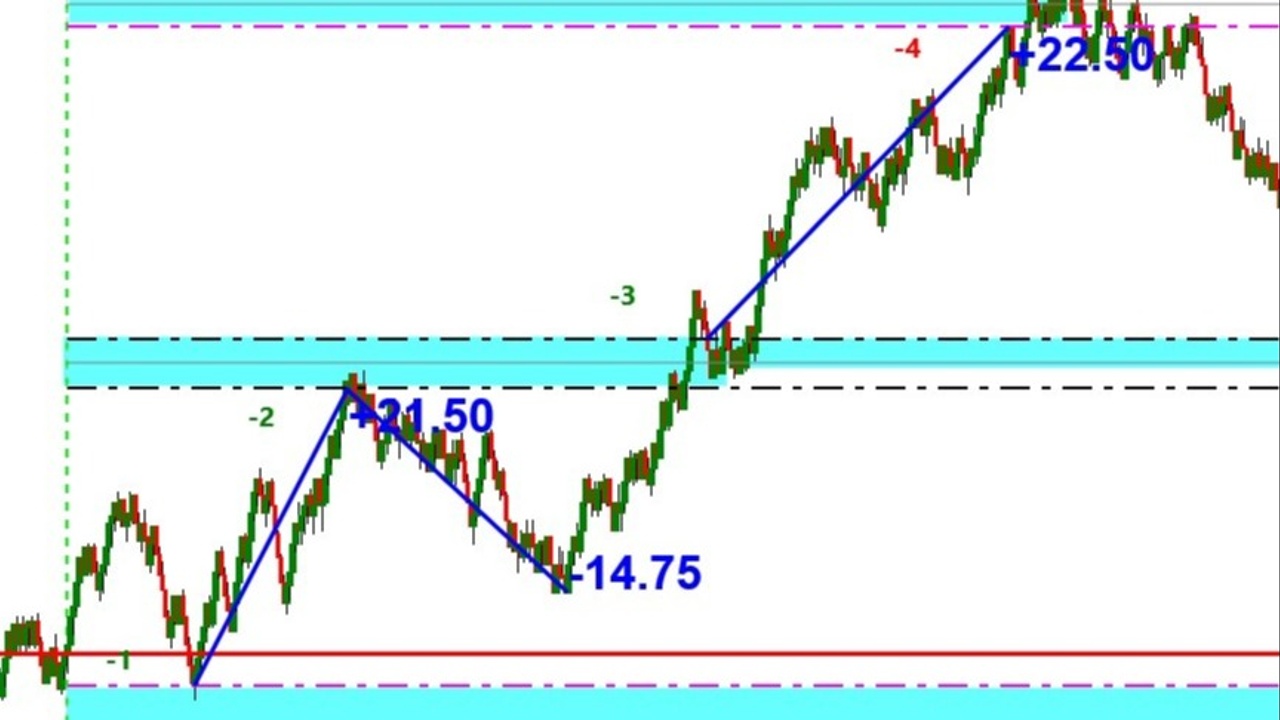

The chart above shows the trade plan levels for last night’s Globex. Five trades, three winners. Decent moves. Join me on Sunday, June 19 @ 5PM ET for my new FREE mini-class “Day Trading for Day Workers.” Click here to register.

Today’s Best S&P Turning Points:

Sell 3828.00 stop 3832.75.

Buy 3713.75 stop 3708.00.

Trade Fearlessly,

Mike Sie...