Trade Aptitude

Results of Tuesday’s Best S&P Turning Points: Neither volume level triggered.

Today’s Best S&P Turning Points (trades are cancelled between 14:00 & 15:00 ET due to FOMC volatility):

Buy 4014.75 stop 4009.25. Short 4073.50 stop 4077.50.

The World Sentiment Index: (+100/-100) drops from +92 to +50 in a bullish world.

Catalysts: Crude Oil Inventories @ 10:30. FOMC Announcement @ 14:00, press conference @ 14:30.

Quick Tip: You’re Biased

No offense. There are so many cognitive biases that affect our trading results and everyone has some. Possibly the worst bias to have is called Personal Blind Spot.

It occurs when you fail to recognize your weaknesses and shortcomings, leading to suboptimal trading decisions and poor performance.

One of the primary ways to resolve this bias is through self-reflection and self-awareness. You must take the time to assess your strengths and weaknesses and be brutally honest about their limitations.

Easier said than done, so seek feedback from ...

Trade Aptitude

Results of Monday’s Best S&P Turning Points: Buying 3895.25 missed filling by 2 points and was the low of the session. Shorting 3999.00 filled in the Globex last night and ran for 9.25 points.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3951.50 stop 3946.25. Short 4073.50 stop 4077.50.

The World Sentiment Index: (+100/-100) SOARS from -7 to +92 with all major world markets very bullish. Historically price closed higher 63% of the time.

Catalysts: Existing Home Sales @ 10:00. Risk on mood.

Quick Tip: The Live Trade Plan

In your trade plan you’ve established a set of rules that when followed, show a positive outcome. You have an edge.

Most trade plans start simple. When to enter and exit. Which asset to trade. Which tools to use. How much to risk.

That’s a good start but the real meaty rules come from live trading experience. We can’t possibly consider all outcomes and influences in the beginning. We need to trade live,...

Trade Aptitude

Results of Friday’s Best S&P Turning Points: Neither suggested trade triggered.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3895.25 stop 3890.50. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) dumps from +50 to-7 in a world of mixed sentiment.

Catalysts: Nothing on the economic calendar. Banking crisis widens. Waiting on FOMC Wednesday.

Quick Tip: Hybrid Trading

There is no “one way” to trade successfully. There are countless strategies and methods that can be profitable. You need to find what resonates with your trading psychology, style, and risk tolerance.

For example, consider two popular styles of trading: trend following and mean reversion. They both can be very profitable given the right rules and discipline to follow them. But the experience of trading each is quite different.

Trend followers will typically have many small losing trades and fewer large winning trades. That’s the nature of tren...

Trade Aptitude

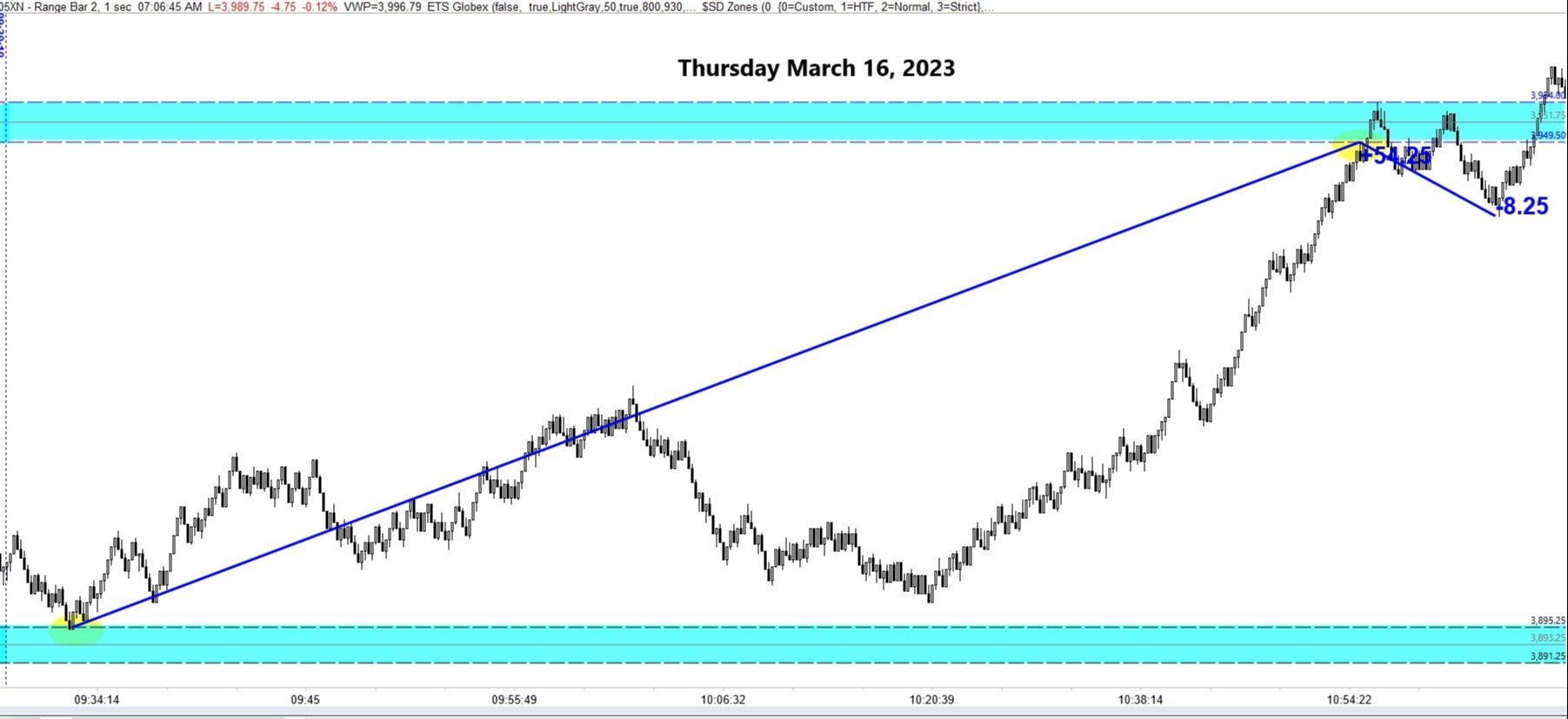

Results of Thursday’s Best S&P Turning Points: Buying 3895.25 picked the bottom of the session and ran for 54.25 points to the suggested short @ 3949.50, which only offered an 8.25-point reversal. Feel better about the win by donating a slice to my preferred charity, the Alzheimer’s Association. Click here.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3913.50 stop 3908.25. Short 4073.50 stop 4077.50.

The World Sentiment Index: (+100/-100) SOARS from -14 to +50 with all major world markets bullish while the S&P futures are lagging. Historically the market closed lower than the open 58% of the time.

Catalysts: Industrial Production @ 9:15. Consumer Sentiment (including preliminary Inflation) @ 10:00. Co-opetition among big banks suggests the banking problem isn’t over. Fed chips in, too.

Quick Tip: Getting Lucky

Happy St. Patrick’s Day! The perfect time to discuss luck in trading. Does it exist? Of course. From a mathematics ...

Trade Aptitude

Results of Wednesday’s Best S&P Turning Points: Neither suggested trade triggered.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3895.25 stop 3890.50. Short 3949.50 stop 3954.75.

The World Sentiment Index: (+100/-100) drops from -43 to -14 in a world of mixed sentiment, Asia Bearish, western world modestly bullish.

Catalysts: Jobless Claims, Philly Fed MFG Index, Housing Starts & Import Prices @ 8:30.

Quick Tip: Try Waiting

Successful trading skills are very different in many cases than how we’ve been conditioned to believe and behave.

We all were taught winning and being right were good, losing and being wrong were bad. These concepts don’t apply to a probabilities game like trading.

Here’s another example via some advice from arguably one of the best traders in history, Jim Rogers.

Jim Rogers quote: “I just wait until there is money lying in the corner, and all I must do is go over there and pick it up. I do nothing ...

Trade Aptitude

Results of Tuesday’s Best S&P Turning Points: Neither suggested trade triggered and remain on the chart.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3833.00 stop 3827.75. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) drops from -29 to -43 with Asia neutral/positive and the western world very Bearish on high volatility.

Catalysts: PPI, Retail Sales & Empire State MFG Index @ 8:30. Housing Market Index @ 10:00. Crude Oil Inventories @ 10:30. Risk off.

Quick Tip: Winning Streaks

It seems like we spend plenty of time discussing how to handle losing streaks and drawdowns. What about winning streaks?

Our intraday trend strategy is up 118.75 S&P points in the past two days with 10 winners and 3 losers. If you traded the Globex last night you banked another 71 points on a single trade.

Winning streaks can be a double-edged sword. On one hand, they can boost confidence and motivation, but on the other hand, t...

Trade Aptitude

Results of Monday’s Best S&P Turning Points: Buying 3864.50 stopped out in the pre-market.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3833.00 stop 3827.75. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) increases from -57 to -29 in a world of mixed sentiment.

Catalysts: CPI @ 8:30. Eyes on financials.

Quick Tip: A Different View

You’ve probably heard the phrase “trading is simple, it’s just not easy.” Indeed, trade plans can be simple to execute but because of our thoughts, emotions, and behaviors we make it hard to follow thus missing the result we want.

Let’s say your “simple” trade rules were based on 1) Determine the big picture trend, 2) Sell rallies in a downtrend on a shorter time interval, 3) Buy dips in an uptrend on a shorter time interval. This is not only simple, but it makes sense. Price moves in waves of impulses and corrections within a trend.

It turns out that your results can also m...

Trade Aptitude

Results of Friday’s Best S&P Turning Points: Buying 3892.50 stopped out. The breakout short from there ran for only 9.75 points.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3864.50 stop 3860.50. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) EASES from -86 to -57 with most major world markets very bearish on higher volatility. S&P Futures are currently bucking that trend near flat. Historically the close was lower than the open 73% of the time.

Catalysts: Nothing on the economic calendar. SVB & Signature Bank depositors saved but who’s next? CPI tomorrow.

Quick Tip: Why Day Trading?

Whenever I tell someone I’m a day trader they usually react with a blank stare and say something like “That’s very risky, isn’t it?” Then I’ll say that regardless of your time horizon, you need to have a solid risk management plan in place.

It usually ends there. Occasionally, they’ll keep asking questions digging deeper f...

Trade Aptitude

Results of Thursday’s Best S&P Turning Points: Shorting 4012.75 ran for 64 points to the buy at 3948.75 which bounced and ran for 10 points. Read the Quick Tip for a discussion on the short.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3892.50 stop 3887.50. Short 3999.00 stop 4004.75.

The World Sentiment Index: (+100/-100) DUMPS from -36 to -86 with all major world markets very bearish on higher volatility. S&P Futures are currently bucking that trend near flat. Historically the close was higher than the open 58% of the time.

Catalysts: Employment Report @ 8:30. Treasury Statement @ 14:00. Banking sector plummets on SVB scare, concerns abound on a bigger problem.

Quick Tip: Fine Tuning

Yesterday’s short volume level was a tricky trade to report. If you followed the suggested stop you stopped out, only to see the trade run 64 points. If you gave it some extra room, as is suggested for faster markets, you sold the top then cau...

Trade Aptitude

Results of Wednesday’s Best S&P Turning Points: Buying 3976.00 ran for 27.25 points on day with a range of 31.75! Tips accepted via CashApp.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Buy 3948.75 stop 3943.00. Short 4012.75 stop 4018.50.

The World Sentiment Index: (+100/-100) DUMPS from zero to -36 in a mostly Bearish world of low volatility. Historically the close was higher then the open 55% of the time and 1.5X the size of down moves.

Catalysts: Jobless Claims @ 8:30. Tomorrow’s Jobs data will be a bigger catalyst.

Quick Tip: Your Report Card

Since we’re in a “numbers business” as traders it makes sense to assess our performance objectively for every trade, not just how much the account is growing.

Most traders will think that a losing trade was a bad trade. Not so. The losers are inevitable and are out of our control if we’re following our plan. A bad trade is actually one where you broke the rules, win or lose. Good t...