Trade Aptitude

Monday’s Best S&P Turning Points Results: :Neither volume level triggered.

Today’s Best S&P Turning Points (consider wider stops and less size in fast moving markets):

Short 3896.00 stop 3901.75. Buy 3719.25 stop 3713.50.

Quick Tip: Move Stop or Not?

Yesterday you learned how to optimize your stop placement. How about moving it as the trade goes in your direction?

Never moving your stop is saying market conditions don’t change, which makes no sense at all.

In our trading room we find that aggressive stop movement is warranted in certain market conditions. Slow stop movement is warranted in other conditions. Let’s define the difference between “aggressive” and “slow” stop movement.

Using our strategy rules the aggressive exit moves the stop to breakeven for the trade itself after target 1 is filled, and to breakeven for remaining contracts after target 2 is filled. This creates more breakeven trades, and you’ll miss some good runs. The tradeoff is less and smaller losses.

Our slow exit moves the stop to a trailing pivot after target 2 is filled. Less breakeven trades, more losers, more longer runs.

These rules assume you’re scaling out of a position with multiple contracts. If you’re not you can set your preferred targets where you’ll move the stop, but not scale out of the position.

Choice depends on market conditions. Slow stop movement is better in choppy or fast conditions giving the trade more opportunity to succeed.. Rapid stop movement is better in smoother trending markets, so you don’t give up too much of your gain (consider re-entry on strong trends).

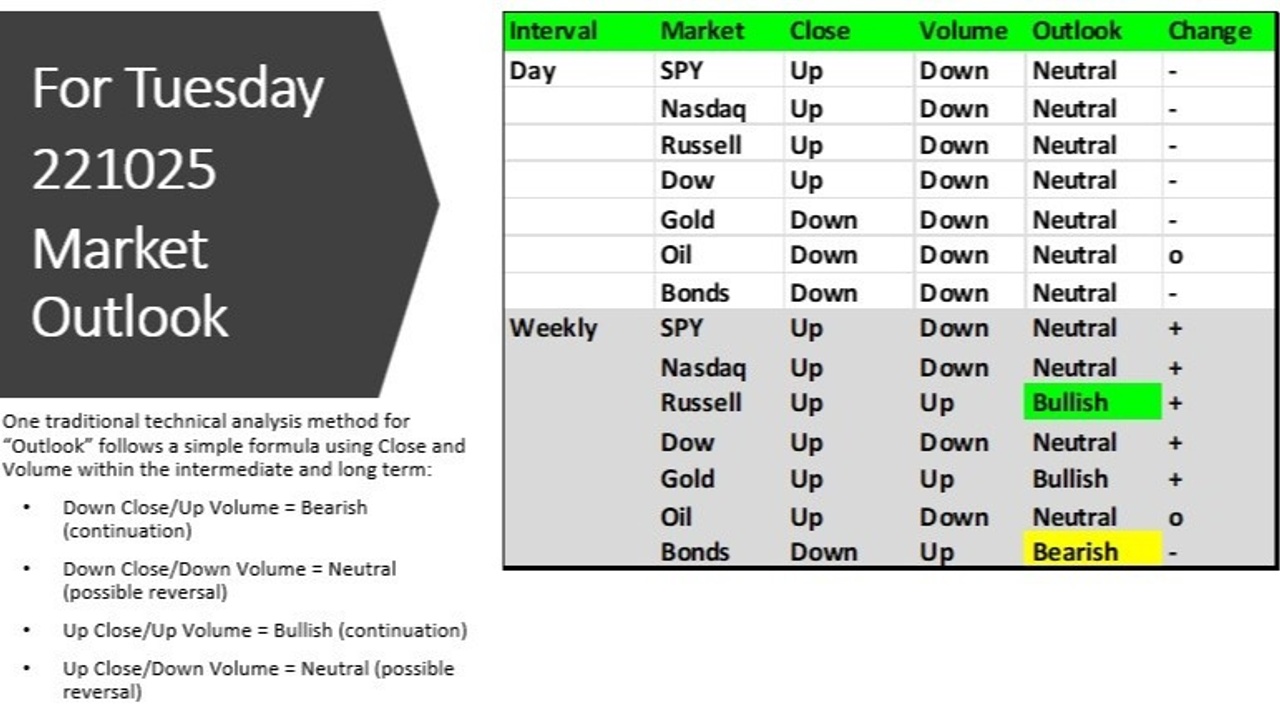

The World Sentiment Index: (+100/-100) DROPS from +21 to -14 in a world of mixed sentiment. Historically price closes above the open 74% of the time.

Catalysts: CS Home Price Index @ 9:00. Consumer Confidence @ 10:00. MSFT/GOOG report after the close (careful on the Globex open).

Trade Fearlessly,

Mike Siewruk

P.S. Multiple strategies, software tools, teammates, and coaching. Learn why you should join our team here. For a personal consultation to assess fit (without selling) email me for an appointment: mike@thedailymarketforecast.