The Daily Market Forecast... recycle this indicator

Today’s Lesson: A new use for ATR

Welles Wilder was mentioned yesterday when explaining a use for his Parabolic SAR. Possibly his most famous indicator is ATR (Average True Range). The word “true” in the name refers to the fact that this includes gaps in the calculation. Average Range would not.

There are numerous ways to use ATR in your trading. One common way is to position your stop loss as a multiple of ATR, expecting that price won’t go there (anytime soon). Likewise, you can use it for profit targets.

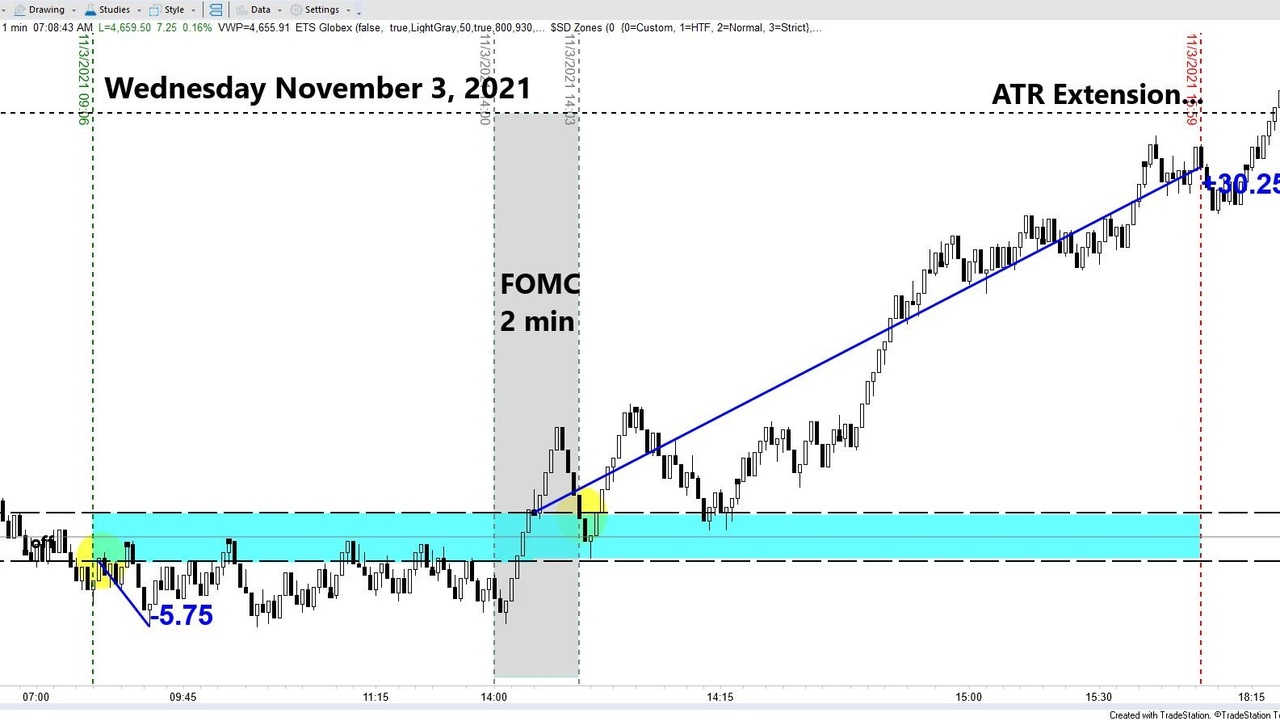

One way I’ve found that can be uncannily accurate is ATR Extension. Looking at the chart above you’ll see a dotted line near the top. This was the ATR added to the prior day’s close. There is another (unseen on the chart) line for ATR subtracted from the prior day’s close.

These ATR extensions act like magnets when price runs far. They can be stalls, reversals or simply profit targets. Think about it, price has made an extended move and could be getting tired. As with all technical indicators, nothing works all the time but if you start using ATR Extension on your charts and watching the reaction you’ll be better prepared.

Trade Well,

Mike Siewruk

P.S. For a free “mini-course” packed full of lessons on HOW to trade the Blog… Watch this video.